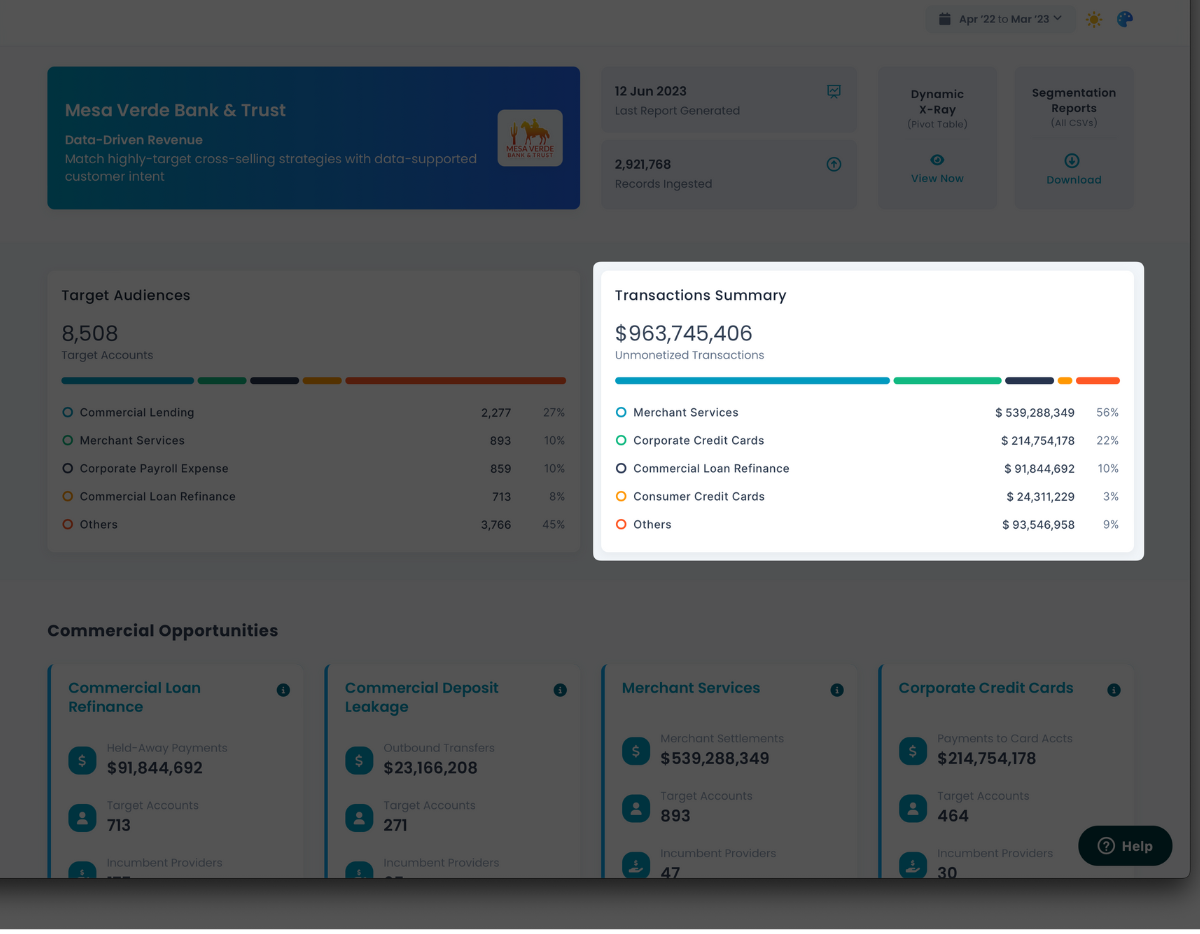

Have you ever wondered how much of your customers’ transaction volume is generating revenue for your competitors instead of your bank? With Revio, you can transform this curiosity into knowledge. We’ve conceptualized this phenomenon as “unmonetized transactions,” a surprisingly common occurrence among banks.

Consider this: You notice a longtime customer, Mrs. Patel, has started making significant monthly transfers to an investment platform not affiliated with your bank. She’s been banking with you for years, and you have a strong wealth management practice — but these transfers indicate she’s now investing her money elsewhere. Why is she investing through a third party? More importantly, why wasn’t your bank her first choice for these services?

Our definition of unmonetized transactions encompasses:

- Payments to loans and LOCs held elsewhere

- Deposit leakages (transfers to external deposit accounts & P2P payment platforms)

- Merchant service settlements via third-party processors

- Payments to credit cards issued by other banks

- Transfers to third-party investment platforms

The real question: how much are these unmonetized transactions costing you? On average, we’ve found that the annual dollar volume of unmonetized transactions in community and regional banks in the US is roughly half of their current asset size. While this rule of thumb gives you an estimate, precise measurement necessitates advanced transaction categorization and analysis.

The revenue opportunity tied to each unmonetized dollar varies. It’s dependent on factors such as your typical markup over interchange for merchant services, credit card payment margins, the present value of loans being paid, the size of assets under management associated with investment platform transfers, and potential return on deposit leakages if retained.

Unmonetized transactions don’t just represent missed revenue. They also pose a risk to your customer relationships. Fragmented banking relationships indicate a shift in customers’ perception of their “primary bank,” making you more vulnerable to losing business to competitors. In today’s banking landscape, attrition is no longer a single event. Customers can maintain active accounts while transferring the bulk of their banking activities elsewhere.

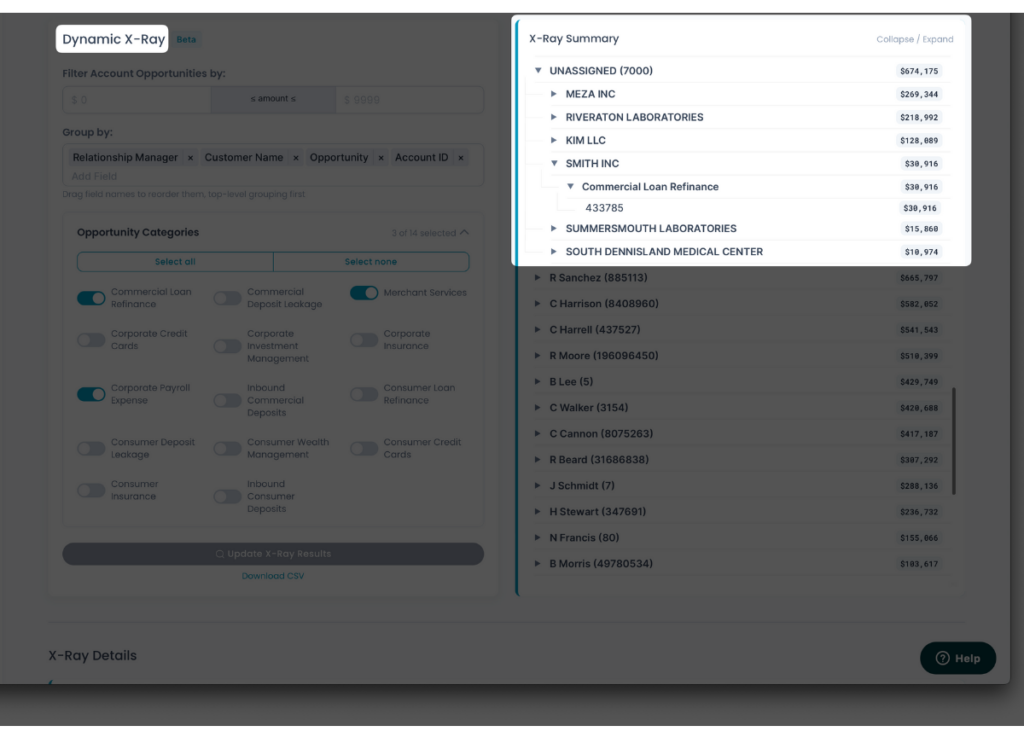

The antidote to unmonetized transactions is simple, but it’s much easier said than done. You need to engage your customers personally to understand their needs and offer your products and services to bring more of their financial services back into your bank. But you only have a finite number of salespeople or relationship managers, and they each only have so many hours in the day.

Which customers should you start with? What products should you offer to each customer? And which customers are high-value enough that you should be following up with them by phone, as opposed to just sending a single email? These are the hard questions, and Revio can help with all of them.

If you’re ready to discover the actual dollar volume of unmonetized transactions flowing in and out of your customers’ accounts — and to leverage Revio’s system for prioritizing your customers for high-ROI cross-selling to reclaim this lost revenue and fortify your customer relationships — we’re ready to guide you through the process.