Navigating the data-driven landscape can be daunting. You’ve heard it all: “Data is the new oil.” And yet, the shadow of “data guilt” seems to loom large. Across the industry, banks pour resources into report-builders, data lakes, and warehouses. These are noble endeavors, for sure. But without vision, you’re left with vast datasets and, well, what next?

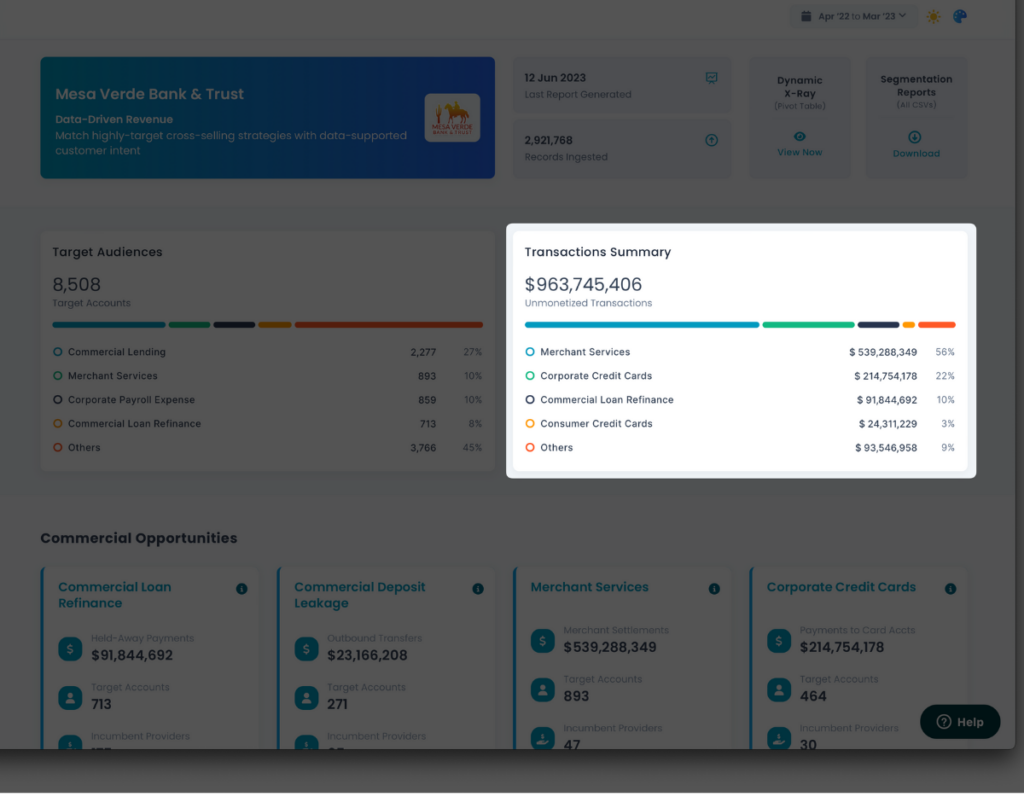

💡 Turn Data Guilt into Growth:

- Classify Transaction Data: Don’t just scratch the surface. Go deep. Recognize transactions, especially those with competitors. It’s like they’re waving a flag, saying, “Hey, talk to me!”

- Automated Outreach: Put those high-value leads right into your CRM. Equip your sales team to reach out. Sometimes, all it takes is one timely conversation.

- Personalized Marketing: Craft campaigns that resonate. If someone is using a competitor’s credit card, show them why yours is the real deal.

- Build Trust: This isn’t a numbers game. It’s about genuine connection. Show your customers you’re in their corner. Loyalty? It’ll follow naturally.

- Drive Growth: Amplify your customer LTV. With every insight you act on, you’re setting the stage for consistent, organic growth.

Remember, think of data as your trusted advisor, steering you towards insightful choices. It’s not about drowning in numbers; it’s about making them count.

📢 Calling all banking leaders! Your data is brimming with stories and insights about your customers. And elevating your data program from a cost center to a growth-driver doesn’t have to be complicated. Ready to dive in?