Banking veterans, have you ever wondered why, in an age of technological wonders, it feels more challenging to grow your business? We’re surrounded by advancements meant to simplify tasks, but it feels as if the banking landscape is only getting more complex.

As we analyze banking data, certain trends and observations emerge consistently…

🏦 Evolution of the Banking Landscape

- Gone are the days when being the only bank in town meant assured growth.

- The emotional connection of a customer proclaiming, “First XYZ Bank is my bank” is fading.

🌐 The Double-Edged Sword of Technology

While technology streamlines operations, it amplifies competition in two critical ways:

- Boundless Competition: The bank down the street is the least of your concerns. Every bank, credit union, and fintech, irrespective of geography, is your competitor. Opening a new account is now a mere few taps on a smartphone.

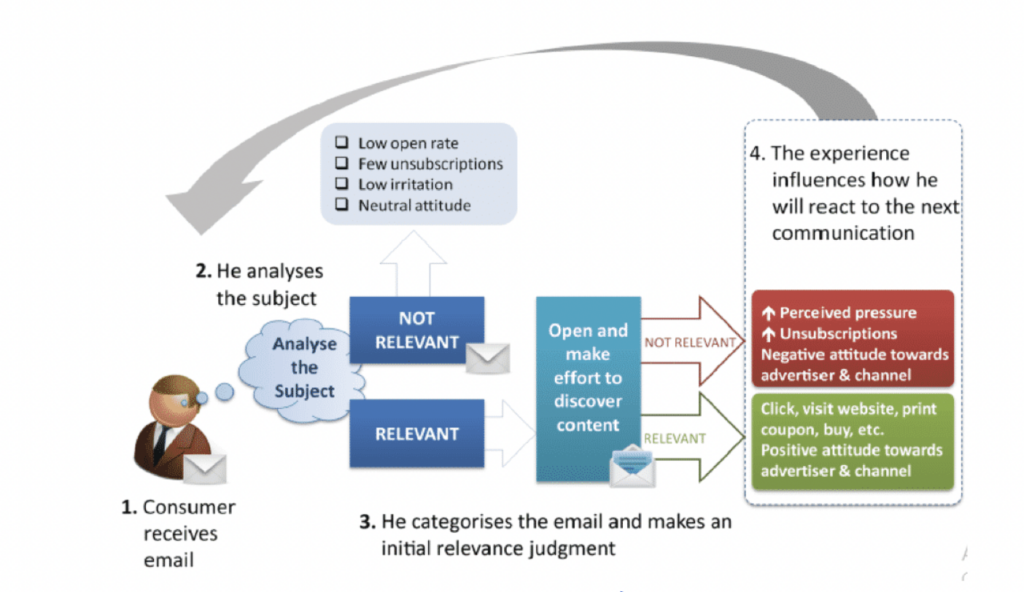

- Fragmented Loyalty: Customers no longer commit to one bank; they diversify. Before, customer attrition was obvious, but now it’s a gradual drift, as they keep their accounts open at your bank, quietly explore alternatives, and adopt additional products from competitors.

💸 The Digital Dilemma

Relying solely on digital customer acquisition might seem like the solution. But can you realistically compete with VC-backed fintechs, whose strategies often revolve around aggressive growth and potential buyouts, rather than profitability? And if you “acquire” a customer, only to be a small part of their larger financial landscape — how much growth does that new customer truly represent for you?

💡 The Path Forward

Your unique advantage is personal service. Mega-banks and fintechs can’t offer the personalized touch a community or regional bank can. With strategic engagement, you can recapture that sentiment of being “the only bank on the block” for your customers.

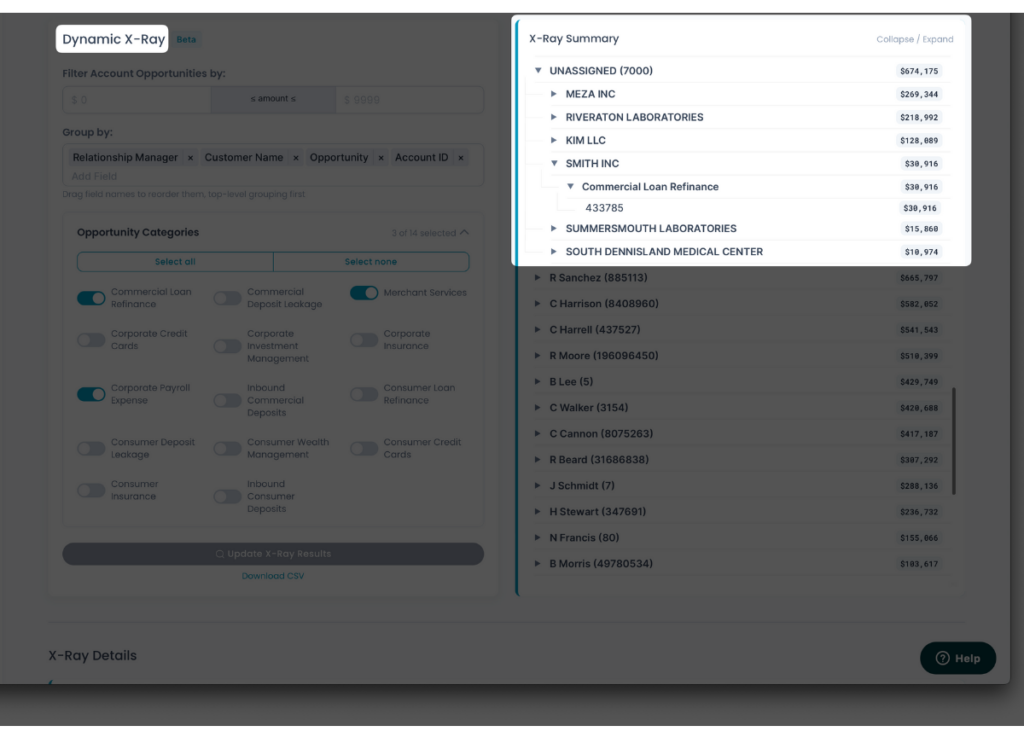

🔍 Data is Your Advantage

The data in your core processing system holds invaluable insights about your customers, waiting to be uncovered. By understanding their external banking activities, you can prioritize and tailor your outreach. While engaging and catering to every customer equally isn’t feasible, the 80/20 rule suggests that focusing on key clients (those who have already become significant customers of competitors for certain products or activities) can yield significant ROI and foster growth.

To all community and regional banking leaders: It’s time to play to your strengths. Understand your customers through your data, prioritize and engage the right ones, and help them remember what it means to be “their bank.”