Bankers, have you ever felt overwhelmed by the constant stream of marketing messages you receive from a merchant or vendor? If so, you’ve experienced marketing fatigue firsthand, a phenomenon that’s especially prevalent in the banking sector.

An opted-in marketing audience is a vital asset for businesses, particularly for banks. As Snigdha Patel at REVE Chat points out, the average customer acquisition cost (CAC) for the banking sector, which has risen above $300, has been influenced by the repercussions of Covid-19 and digital channel saturation. In such a context, it’s crucial to ensure that our marketing strategies don’t alienate this valuable audience.

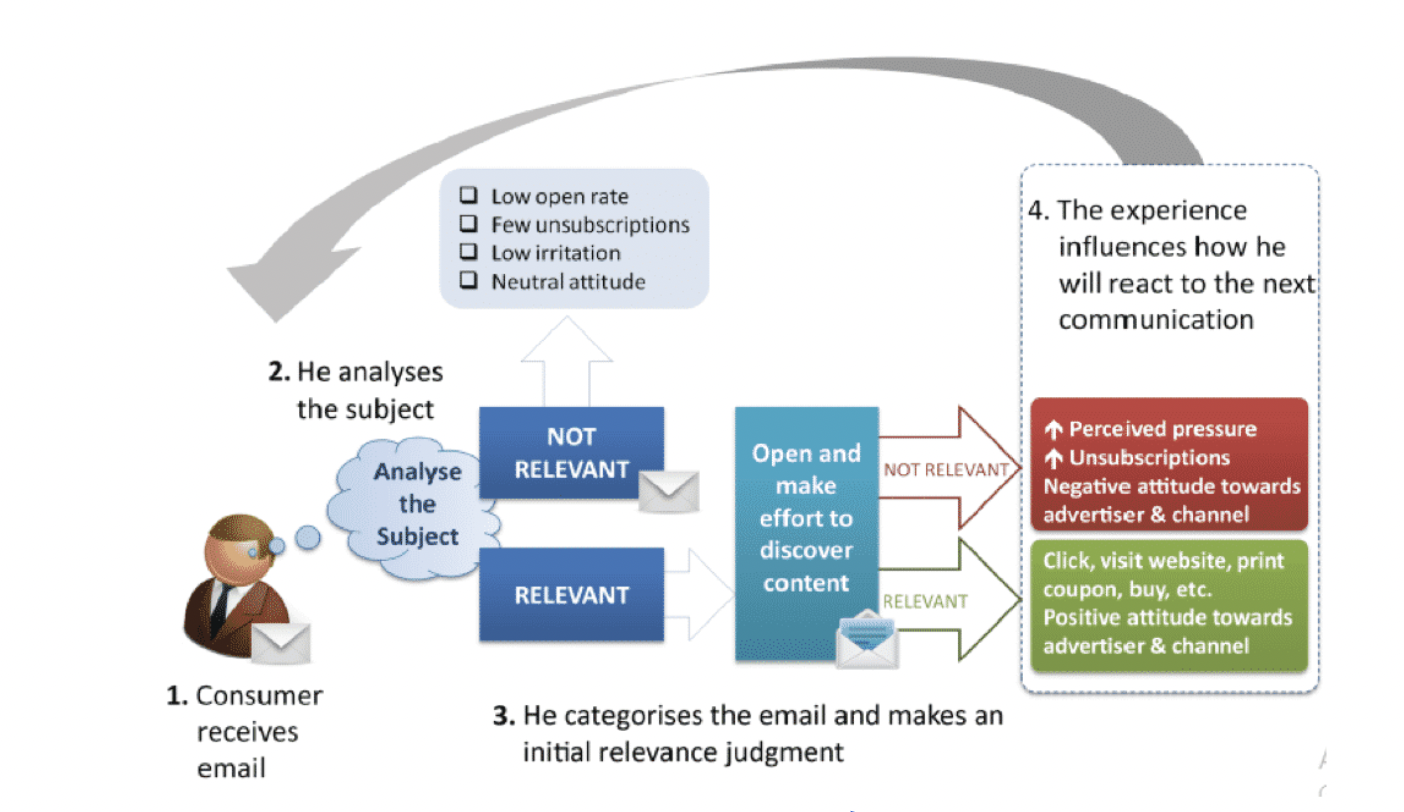

As Anastasia Belyh from Cleverism aptly describes, “Marketing fatigue is a situation where customers get tired and exhausted from being exposed to too much marketing communication from the same brand.” This can lead to:

- A sense of overwhelming pressure.

- Increased unsubscriptions.

- A negative perception towards the marketer and their communication channel.

While the initial outreach might result in decent engagement, repetitiveness and irrelevance can tarnish the brand’s image. Over time, this can train customers to overlook offers, leading to declining engagement and even brand aversion.

So, how can banks balance cross-selling without overwhelming their clients? The answer lies in leveraging data from their core processing system for tailored cross-selling campaigns.

Avoid Marketing Fatigue with Segmentation & Personalization

- Manage Offer Frequency: Protect customers from irrelevant offers. When they finally receive an appropriate offer, their attention is heightened, possibly even strengthening brand loyalty.

- Personalize Offer Content: Segment the audience based on criteria, ensuring content addresses the unique needs of each segment.

- Increase Offer Relevance: Craft offers that feel tailor-made, conditioning customers to anticipate new, relevant promotions.

- Diversify Channel Selection: Choose communication channels based on segmentation to effectively reach different customer groups.

- Optimize Resource Investment: Allocate more resources to high-value customer segments, ensuring the best ROI for your campaign.

Boost Conversion: Segmentation and personalization don’t just ward off marketing fatigue; they also elevate conversion rates. As evidenced by a report from MailChimp, segmented emails witness higher open and click rates and enjoy a lower unsubscribe rate.

Turning Data Into Revenue

Your core processing system undoubtedly holds a wealth of essential data. However, extracting actionable cross-sell marketing insights from this data is challenging without the right analytics capabilities. Crafting a tailored solution requires expertise across a wide spectrum: banking, growth strategy, transaction analytics, data modeling, machine learning, software development, and product design.

Rather have a streamlined solution? To skip years of custom development, and target and personalize your marketing in weeks — reach out to Revio. Let us guide you through defending against marketing fatigue, enhancing your engagement and conversion rates with ease.