Incorporating customer intelligence into growth strategies can significantly impact a company’s bottom line and operational efficiency. According to McKinsey, organizations that leverage customer behavioral insights outperform their peers by 85% in sales growth and more than 25% in gross margin. This demonstrates the substantial value that can be derived from effectively capturing and analyzing customer data.

Accenture’s research further supports the value of a data-driven approach, highlighting that leaders who prioritize customer experience holistically see a profitability increase year-on-year by at least six times over their industry peers. This suggests a direct correlation between the use of customer data and superior financial performance.

New Customers vs. Cross Sell: If You Want to Retain Customers…It’s Both

New customer acquisition is expensive and on the rise. This means deposit and revenue acquisition costs are on the rise too. Depending on the study you read, customer acquisition costs for financial products range from $300 for retail to over $1,300 for business customers acquired through paid campaigns.

On the other hand, cross-selling to existing customers presents a cost-effective and complimentary approach due to the already established relationship and trust, as well as the existing access to knowledge about the customer’s preferences and needs.

Cross-sell effectiveness compared to new customer acquisition reveals a striking difference in both cost and efficiency. Acquiring a new customer can be 5 to 7 times more expensive than retaining and selling to an existing one. The probability of selling to an existing customer is significantly higher, ranging from 60% to 70%, compared to a mere 5% to 20% likelihood of selling to a new customer.

Retention and Profitability

Regardless of which study you believe, there is a strong connection between understanding customers through data, cross sell effectiveness, and financial performance. Deeper relationships, as defined by the number of products and services or wallet share a bank has with a client, by and large lead to longer customer retention. Retained customers often contribute significantly to a company’s revenue and profitability. For instance, a study by Bain & Company revealed that increasing customer retention rates by 5% increases profits by 25% to 95% over the long term.

Benefit & Challenge for Banking

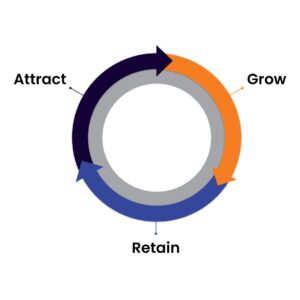

Bottom line up front: Banks seeking to achieve greater financial performance must attract, grow, and retain customer relationships. Community and regional banks can significantly benefit from an integrated data strategy to help target opportunities for retention and growth. This approach requires identifying high-value opportunities and understanding the factors driving customer lifetime value (CLV), which in banking means deep rooted multi-service relationships and good customer experiences. Focusing strategy on increasing lifetime value rather than purely transactional gains, according to McKinsey & Company, leads to better customer outcomes.

It’s not just consultants who have used this approach to grow long term value. Tech companies like Google, Amazon, Apple, Slack, and Salesforce are all real world examples. While tactics and delivery may vary by customer type and industry, these technology companies often seek to understand customer needs through data-driven insights and continuously look for new opportunities to gather information. Insights and information are used in a variety of ways to improve lifetime value: identify customer growth opportunities, personalize offers, enhance customer experience, optimize pricing, and create ecosystems of products and services focused on customer needs.

Banks have a challenge pulling data together and there are limited software services available that enable a turnkey approach. Often data is contained in disparate and siloed sources, which are difficult to access. This prevents many banks from even getting started. Even those that do can face significant roadblocks. A common challenge for banks, as highlighted by McKinsey, is the “started but stuck” phenomenon, where investments in data infrastructure and analytics do not yield expected results. Market conditions have driven banks to build bespoke solutions, which can be time consuming and expensive even without delays.

In today’s highly competitive financial services environment, community and regional banks seeking to gain greater financial performance should explore how customer insights might help them attract, retain, and grow their customer relationships. And while data can inform these growth efforts, banks still must consider the proper engagement channels, whether digital, physical, or relational. We explore this topic in a separate brief.